Posted on November 14, 2019

Oman Insurance maintains its positive business momentum as its net profit grew by 65% to AED 144.2 million in the third quarter of 2019, compared to AED 87.4 million in the same period last year. This growth is supported by strong underwriting results, increased investment income, accelerated collections and leaner operating expenses.

While the Gross Premium Written (GPW) is down 4% at AED 2.84 billion against AED 2.96 billion in 2018, it was a conscious decision driven by selective underwriting and pruning of loss-making accounts in efforts to deliver sustainable profitability.

The company’s Net Premium Earned, highest in the UAE market, increased by 4% to reach AED 1,224 million in the third quarter of 2019 compared to same period last year. Premium retention ratio also improved to 46% (up by 3%) reflecting the company’s enhanced, prudent risk appetite.

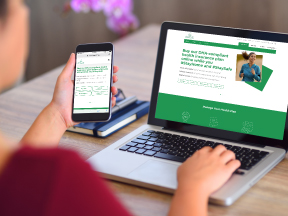

Jean-Louis Laurent Josi, Chief Executive Officer at Oman Insurance commented, “With strengthened fundamentals, I am confident that Oman Insurance is on the right track to deliver sustainable and positive results. Our digitalization journey is reaping results with a recently launched commercial portal for corporate products. Oman Insurance is the first amongst major insurance players in the UAE to launch such a portal.”